The current cost of living crisis and the rise in inflation has posed many different challenges for both employers and employees. Businesses are faced with rising energy and fuel costs, while many people are facing a hike in their mortgage costs also. In these challenging times employers are expected to provide some support for their employees, who are facing unprecedented changes to their lifestyles.

How about introducing a scheme that provides you and your employees with endless benefits…oh and doesn’t cost anything to set up?

The Electric vehicle salary exchange scheme is a non-cash employee benefit which allows your staff to give up part of their pre-tax salary in exchange for an Ultra-Low Emission Vehicle (plug-in hybrid or battery electric car).

Why a Salary Exchange Car Scheme Offers the Best Benefits

Salary exchange schemes are unique, because they provide a type of benefit that an employee can’t receive anywhere else, other than through their work. They are also a fantastic benefit to both the employee and the employer, because they can both make cost savings through the employee paying reduced tax and national insurance contributions.

A car salary exchange scheme is one the most beneficial types of scheme an employee can opt for. Here’s why:

EMPLOYEE BENEFITS

- Access to latest vehicles

- Savings of 20-60% on a new EV when compared to a like-for-like Personal Contract Hire agreement

- No deposit or credit check required

- Fully comprehensive insurance

- Servicing, maintenance and tyres included

- Breakdown cover

- Road tax (where applicable) is included for the duration of the contract

- 2-, 3- and 4-year leases with mileage options from 5,000 up to 30,000 per annum

- Fixed monthly costs

- Leaver protection

EMPLOYER BENEFITS

- Tax efficient way of offering a high-impact, cost-neutral staff incentive

- Retain, attract and motivate talented employees

- Removes inherent risks around ‘grey fleet’ usage

- Reduced Class 1A National Insurance liability

- Fixed monthly costs – no unforeseen expenses

- Early termination cover

- Boosts company environmental image and helps meet sustainability targets

- Minimal employer resource required to administer scheme

- Operating cost savings

So What Next?

It’s important to understand that not all salary exchange schemes are equal, and our research has found that a number of products on the market are unsuitable or not a good fit for SMEs.

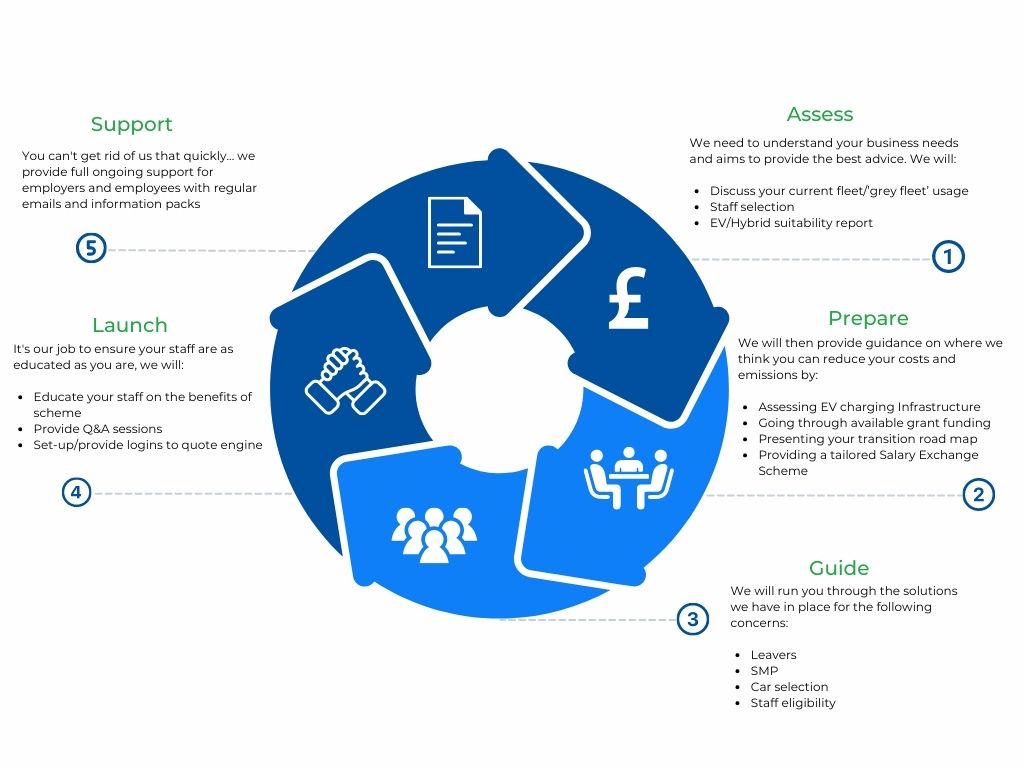

At E-VE, we provide ongoing support to businesses in their transition to electric and the ‘Road to Net Zero’ - we don’t just set-up a scheme and leave you to it! We make the effort to understand and assess your organisation and its current mobility needs to ensure we find a solution that is right for both employees and your business, regardless of size.

Whether it’s identifying the and providing cost-effective and tax efficient solutions, or planning, installing and managing EV charge point infrastructure, or managing and reducing your fleet costs, we’ve developed a full e-mobility package to help your business on every step of its decarbonisation journey.

All you have to do is contact us to get started on your transition to electric…

Even better, let’s meet up for a coffee in Warrington, we’re local!

p- 0800 975 5900