Although in some cases this can be true usually in our personal lives, in a business it’s different- especially with the wider range of leasing options that are now available.

“If it appreciates, buy it. If it depreciates, lease it.” John Paul Getty

Why sink your precious cash into something that loses value over time? Instead, let someone else pay for it and invest your cash more wisely in something that has a higher return.

This paired with the income EV Chargers can generate for a business is very powerful. And that’s without even taking into account the tax benefits.

It’s fair to say that 2022 is the year of Electric Vehicles, therefore it’s becoming essential for all Workplaces to have EV Charging facilities in place. This isn’t only a priority for staff who drive Electric Vehicles, but for businesses themselves to ensure they’re complying with the Governments green goals. Additionally, with the new grant regulation that states that Workplace Charge Points can now be utilised by nearby residents during out of office hours, it’s even becoming an urgency for them.

Even if your business is in a position where you can afford to install Charge Points without having to split the payments across a period of time, financing is still the better option, here’s why:

- Retain capital for other business needs

- Preserve existing credit facilities

- Access the latest equipment with minimal upfront cost

- Offset finance cost against income generated by Charge Point

- Tax savings available including super deduction

- Fixed costs to help with budgeting

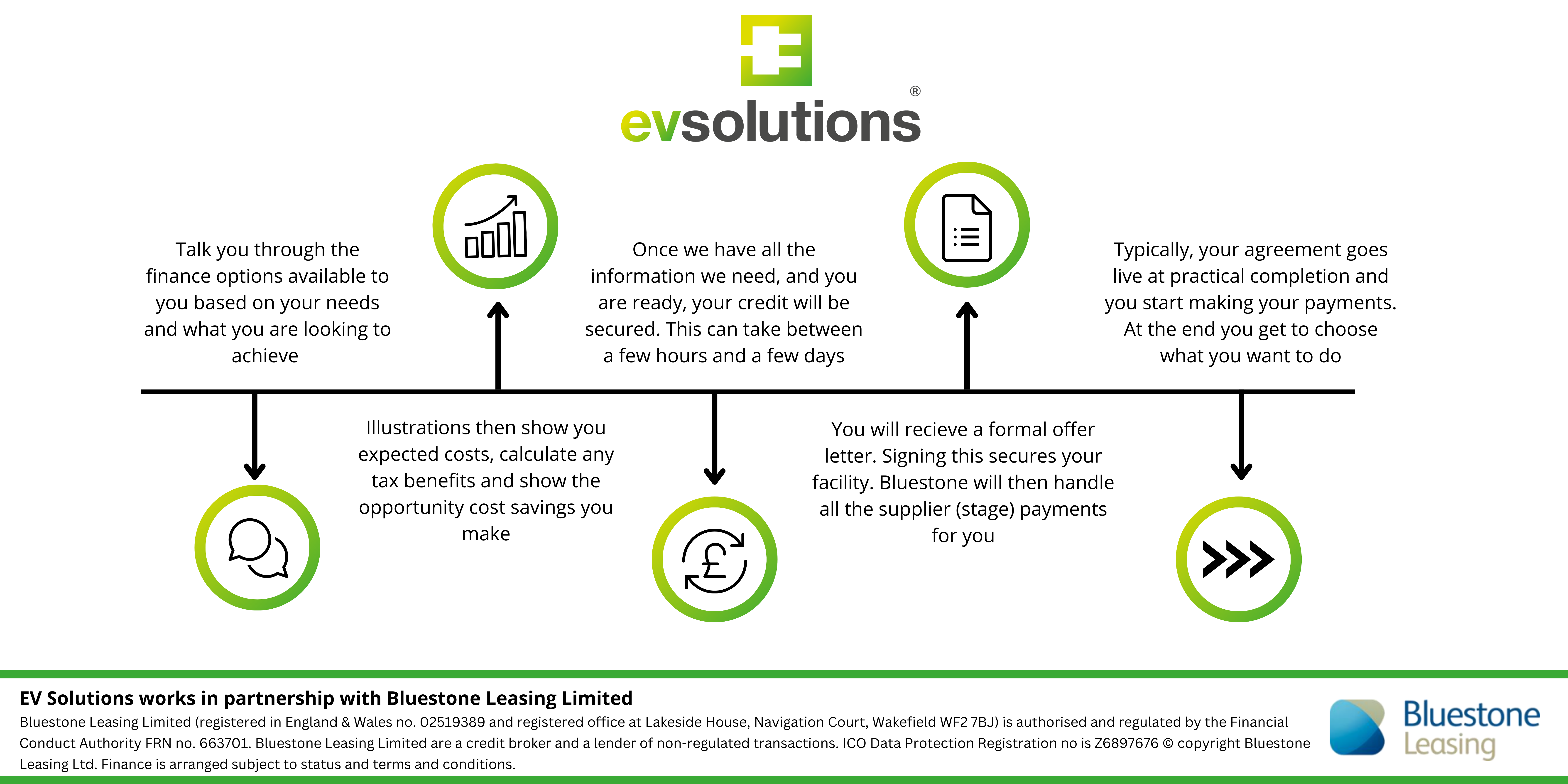

How it all works

Our specialist financing partners Bluestone leasing, will go through a detailed process to ensure you’re getting the most out of your leasing options, whilst we make sure you’re getting the most out of your Charge Points. Below is an illustration of the process of setting up your leasing option.