Car allowance is where an employee receives a cash sum which is then added to their annual salary and can be used to purchase or lease a vehicle of their choice. This has resulted in a substantial increase in so-called ‘Grey Fleet’ vehicles, whereby employees utilise their own cars for company purposes and then reclaimE-VE mileage expenses.

Grey fleet is a vital part of the overall mobility solution for many organisations. With that being said, a recent survey highlighted a worrying lack of awareness about some of the key risks associated with grey fleet vehicles. Driving for Better Business (DfBB) surveyed more than 250 executive directors and in excess of 1,000 employees who drive their own car for work related purposes:

- 90% of those employees surveyed use their own car for business, with 75% doing so at least once a week.

- 60% of directors did not know whether their staff used their own vehicles for work journeys or, if they did, how many there were.

- More than half (53%) of the directors were of the mistaken belief that a grey fleet driver was not the company’s responsibility.

- 68% of directors said their company shared its Driving for Work policy with its grey fleet drivers yet less than half (45%) of those drivers said they had seen it.

- Only 38% of directors said their company routinely checks that their grey fleet drivers have insurance cover for business use, while just over a third of drivers (34%) had never had their driving licence checked

- One in every three grey fleet drivers (33%) confirmed they did not have cover for business use on their motor insurance, meaning that they are, effectively, driving while uninsured.

A Smarter, Safer, Sustainable Solution

At E-VE, they can remove the headache of trying to manage grey fleet vehicles.

Their Salary Exchange scheme provides employees with access to the latest ultra-low emission vehicles and improves your compliance in terms of:

- Insurance

- Servicing, maintenance and tyres

- MOTs*

- Road Tax*

*where applicable

This ensures complete peace of mind that your employees are driving in safe and reliable vehicles, while also improving your business profile and reputation.

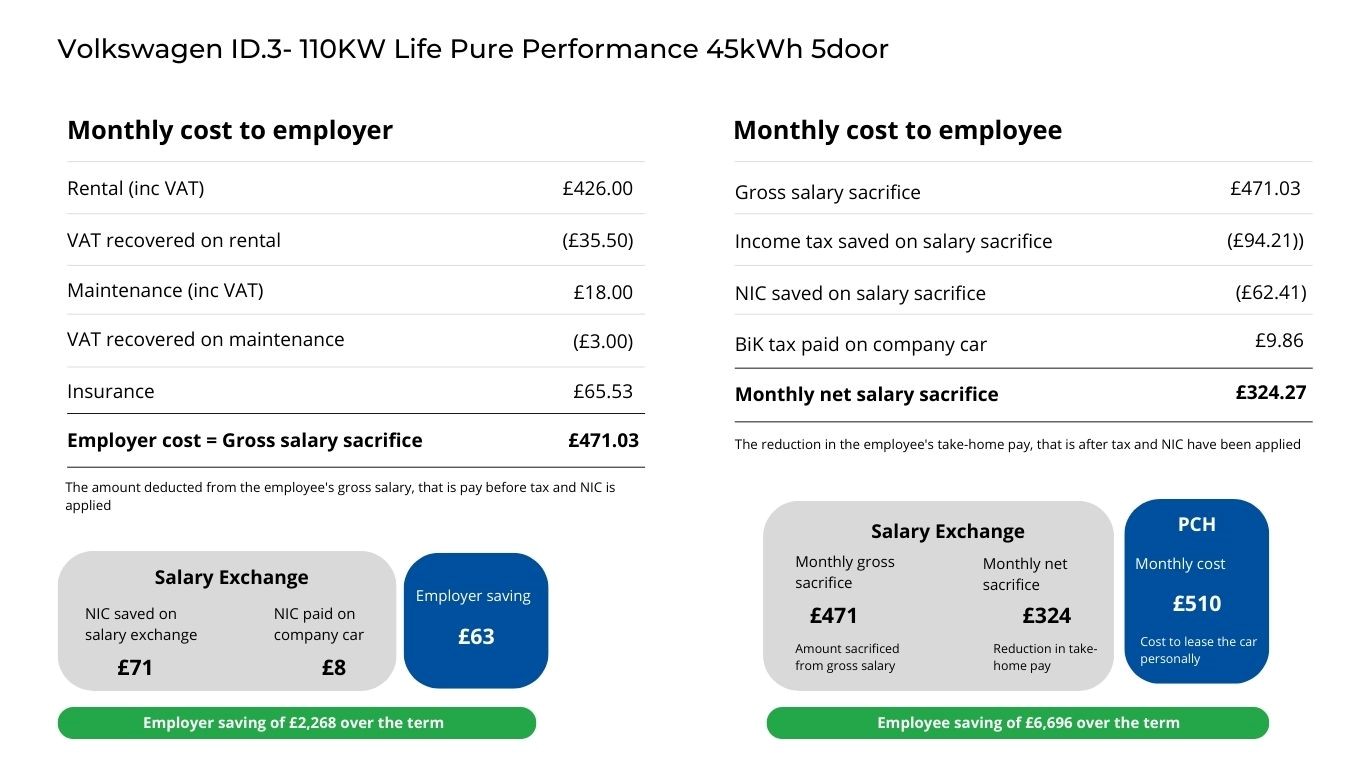

We provide full and ongoing support, assessing the status of your current fleet and advising on where you can make the most cost-effective, tax efficient savings. Check out the table below to see how both employers and employees can save on a Volkswagen ID.3 with a salary exchange scheme.

If you haven’t already, head over to last month’s WBEX newsletter to view our previous post which covers all the benefits of salary exchange. When you’re ready, feel free to contact us!

T: 01925 824901

Salary sacrifice quotation based on a 3 year, 1/0/35, 10,000 miles per annum maintained contract starting on 6 April 2022 for a 40 year old UK basic rate taxpayer residing in Knutsford, on a car with P11D value of £29,580. Assumes the employer is able to recover all VAT incurred, subject to the 50% block on the recovery of VAT incurred on the finance element of the contract hire rental. Income tax, National Insurance Contribution (“NIC”) and Value Added Tax (“VAT”) rates, and BIK percentages, used per latest UK and Scottish government legislation and announcements. Personal Contract Hire (“PCH”) quotation based on a 3 year, 1/0/35, 10,000 miles per annum maintained contract starting on 6 April 2022 for a 40 year old residing in Knutsford. The insurance premium included within the monthly PCH cost is the same as that used for the salary sacrifice quotation. Calculations prepared in January 2022.e-car lease - Salary Sacrifice Employee Guide (240622) (electriccarlease.co.uk)